Key Takeaways from Messari’s Latest Report on the Aptos Ecosystem

Aptos Ecosystem Breaks $1B TVL

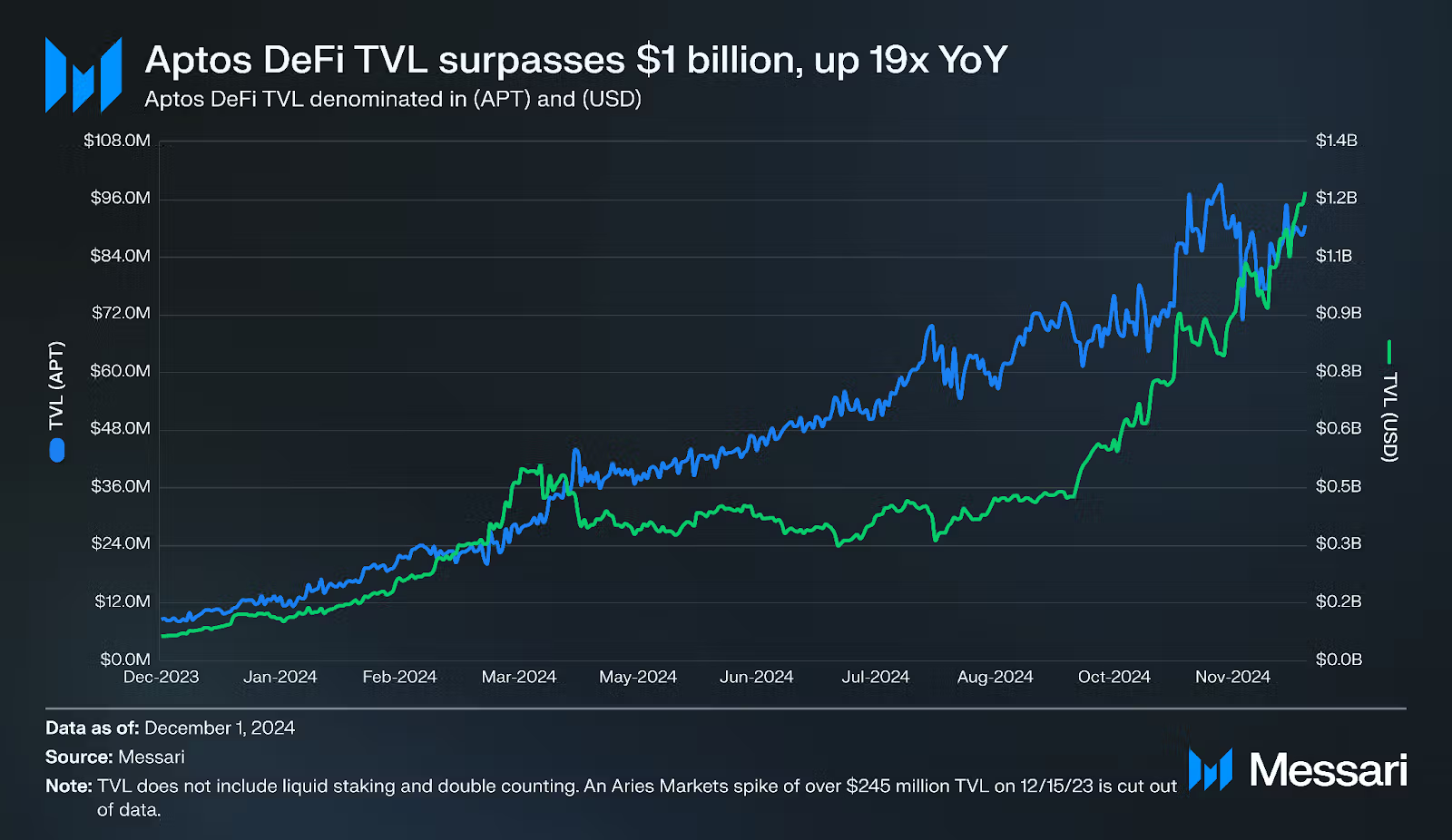

This year marked a transformative period for Aptos, solidifying its place as a leader in the future of finance. In November, the blockchain's total value locked (TVL) surpassed $1 billion for the first time—a remarkable 19X increase year-over-year. This milestone highlights the ecosystem's unprecedented growth, driven by both institutional and decentralized finance innovation.

Major TradFi Players Made Waves on Aptos

Franklin Templeton brought its U.S. Government Money Fund (FOBXX) to Aptos in October. Shortly after, BlackRock, the world’s largest asset manager, expanded its USD Institutional Digital Liquidity Fund (BUIDL) to Aptos, making it the only non-EVM blockchain supported. Together, these integrations highlight a powerful alignment between traditional finance and blockchain innovation on Aptos.

Stablecoin Surge Driven by USDT and USDC

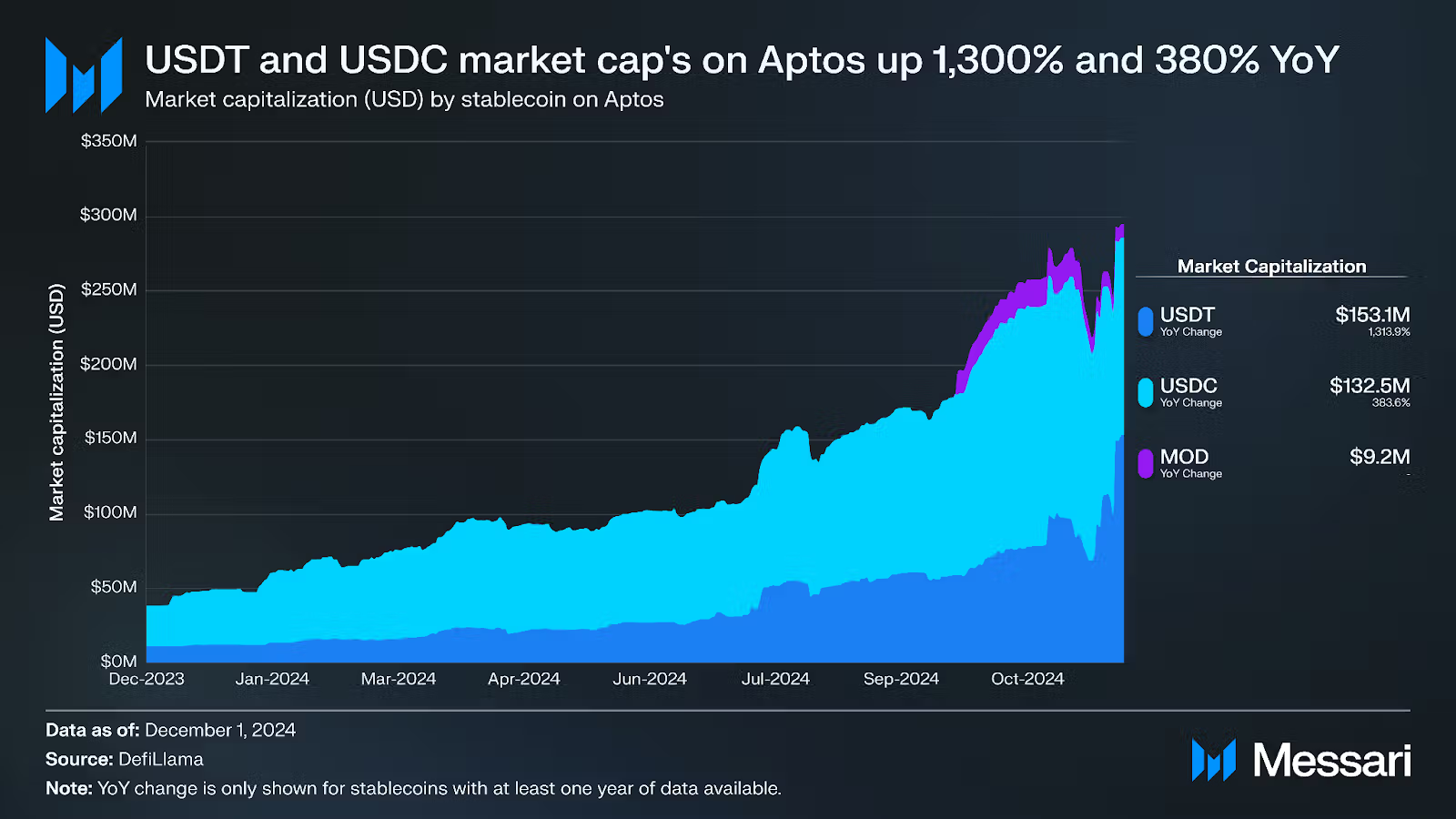

Stablecoin adoption on Aptos reached new heights in 2024. In October, native USDT launched on the Aptos network, bringing one of the world’s most-used stablecoins directly onto the blockchain. Circle’s USDC is also set to launch on Aptos soon, marking another milestone for stablecoin adoption.

Combined, USDT and USDC’s market capitalizations on Aptos are up 1,300% and 380% year-over-year, reflecting growing adoption alongside the expansion of Aptos’ DeFi ecosystem.

Aptos’ DeFi Ecosystem Takes Center Stage

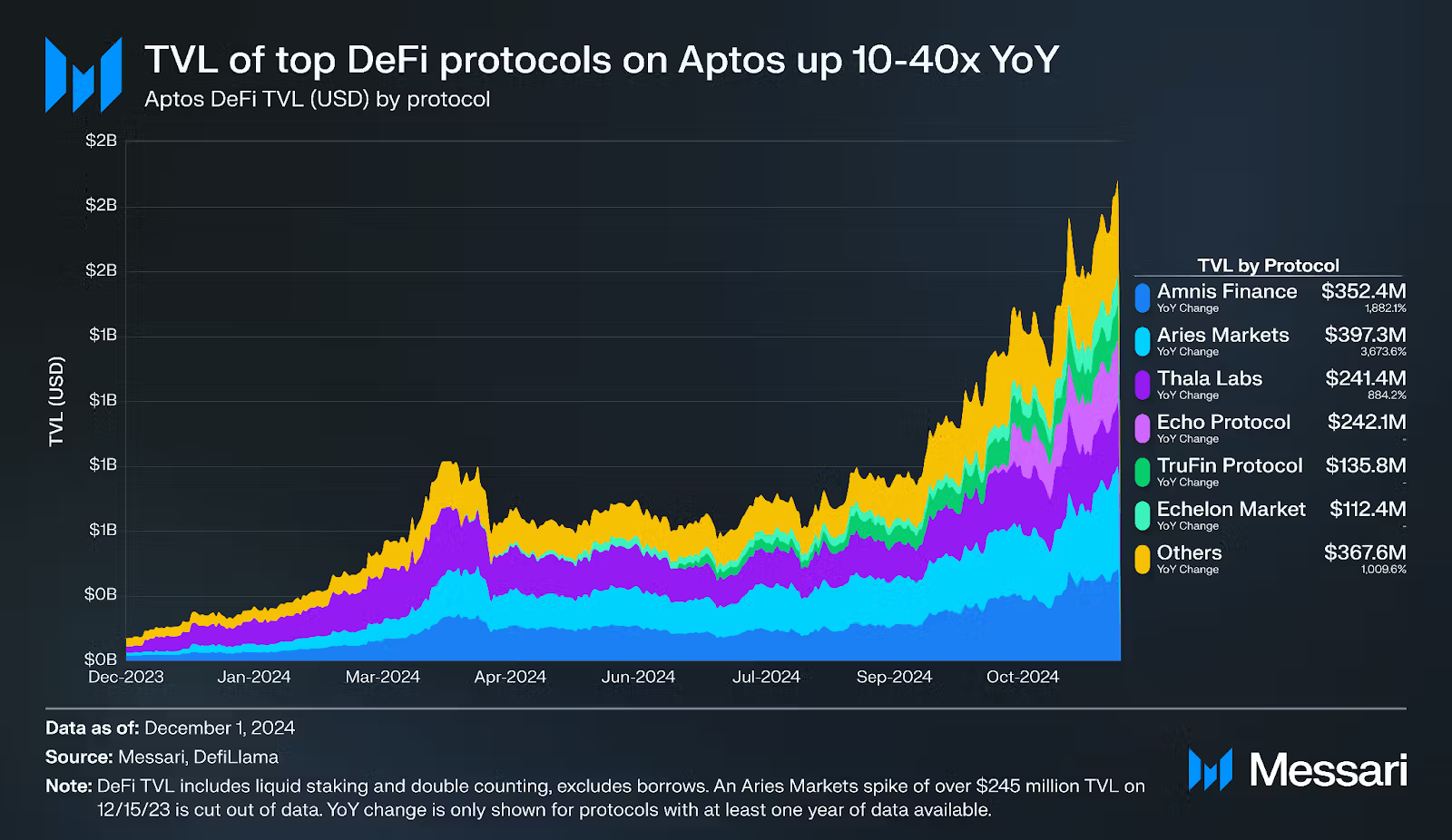

DeFi activity on Aptos has flourished, with daily decentralized exchange (DEX) volumes climbing 28x to $21.5 million in just a year. And among the top DeFi protocols on Aptos like Amnis Finance and Aries Markets, TVL has increased by 10-40x year-over-year. This incredible growth demonstrates Aptos’ ability to attract not just developers but a wide range of users looking for advanced DeFi solutions.

A Year of Defined by Ecosystem Momentum

Surpassing $1 billion in TVL was a defining achievement for the Aptos ecosystem. This represents a 19x year-over-year increase, an extraordinary leap fueled by its growing DeFi and TradFi integrations. The Aptos blockchain is fast becoming the go-to network for institutions and builders alike. The future of finance is taking shape right now—and it’s happening on Aptos.

Read Messari's full report here: “Aptos Financial Ecosystem Analysis”