Unlocking Global Financial Participation with Aptos

tl;dr

Traditional financial systems have historically restricted global growth through barriers like high costs and exclusivity. Today, almost 80% of adults in the world are still either underbanked or unbanked.

Open API banking, exemplified by initiatives like M-Pesa, dramatically expands financial access.

As a blockchain that serves as an upgradeable, industry-leading platform for tomorrow’s financial apps, Aptos is, and will continue to be, a pivotal figure in the upcoming financial revolution.

Introduction: Bridging the Financial Gap

As open banking APIs become increasingly prevalent, it’s clear that open finance systems are the manifestation of a new, better, arguably inevitable economic norm.

From limited access in underserved regions to outdated technology, traditional financial systems have long built boundaries and imposed insular barriers that have left up to 1.7 billion adults around the world unbanked. Even within the United States, widely considered one of the world's wealthiest nations, 22% of its adult population found themselves either unbanked or underbanked in 2019, representing a staggering 63 million individuals grappling with financial exclusion.

The consequences of inaccessibility don’t stop at the individual level, either. Barriers to financial participation equal limited financial growth. In other words, entire economies are not benefitting in the ways they could be if billions of people living within them were brought into the fold.

This kind of inaccessibility should not exist in today’s world, a world with infrastructures like blockchain built to solve these issues. M-Pesa’s success story in Africa alone has underscored open finance’s potential to make economic access more equitable, displace traditional banks, and expand participation. On a global scale, it offers a compelling precedent for technology as a force for broadening access and inclusion.

Secure, scalable, interoperable blockchains like Aptos can and will provide a great home for new and innovative forms of currency, like stablecoins — now expected to grow to $3 trillion in value over the next five years, drawing interest from PayPal and others in the process.

Aptos: Pioneering the Open Financial Revolution

With open financial systems actively preparing for the next era of banking, there’s massive potential for positive change. However, not all blockchains and protocols claiming to provide a sure foundation for the financial revolution are created equal.

Even the most impressive dApps won’t get far when built on constrained and brittle infrastructure. Revolutionizing finance is a serious job that requires a serious blockchain to lay the groundwork. For open financial systems to reach their fullest potential—and to even begin to compete with traditional finance’s legacy—they need a blockchain that provides a resilient, scalable, secure foundation tailored for global inclusivity. That’s where Aptos enters the picture.

The purpose of open finance is to make economic participation more accessible, not more expensive, constricted, or risky. Recklessness has no place in a universally accepted finance system, and Aptos’ tech embodies this point of view.

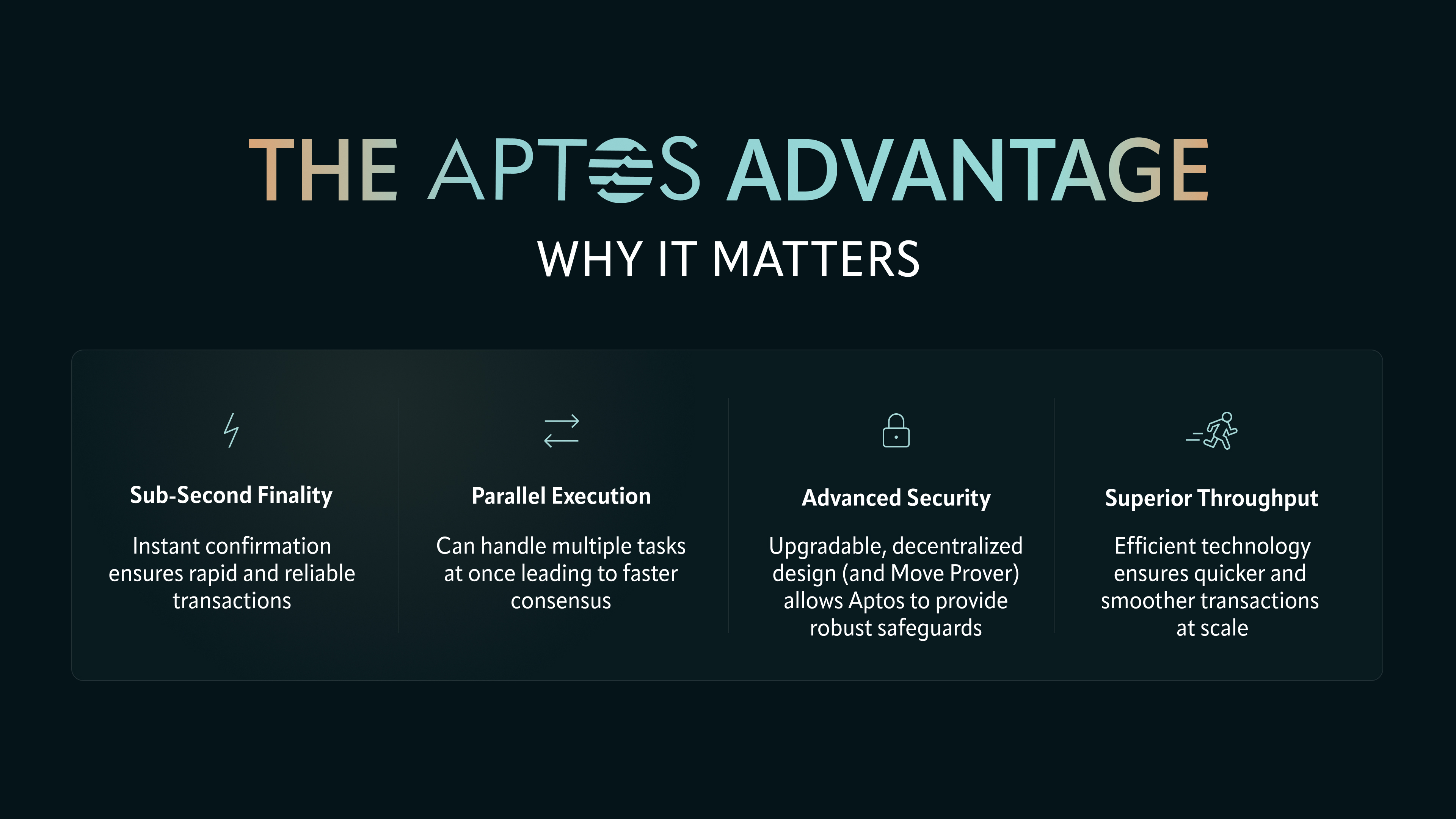

The Aptos blockchain, with its industry-leading sub-second finality and verified parallel execution capabilities, provides countless opportunities for developers everywhere to construct the building blocks of tomorrow’s financial landscape safely. Aptos’ breakthrough technology and programming language, Move, are designed to securely help developers get from ideation to production as quickly as possible. Pioneering developers love the rapidly developing cycles of the Aptos web3 infrastructure stack. Near-monthly upgrades bring new performance improvements and developer features such as Quorum Store and 100x lower gas fees.

The simultaneous speed and security built into Aptos’ tech make it the clear integration partner for today’s most disruptive DeFi protocols, including SushiSwap, Merkle, Amnis and Thala. It’s also why Aptos has been trusted with the Web3 ventures for the likes of Franklin Templeton, MasterCard, and Microsoft on finance-related projects—and with industry giants like Google Cloud and NBCUniversal on projects aimed at expanding what’s possible on‑chain.

If it’s happening in Web3, it’s happening on Aptos.

The Road Ahead

It’s only a matter of time until digital assets become the norm and finance is finally as accessible as it should be.

Key industry players have a limited window to stay ahead of the curve before they fall behind it. As that inevitable moment approaches, financial powerhouses like Franklin Templeton, Coinbase, and Mastercard are building on Aptos. Simultaneously, TradFi giants, DeFi protocols, and other finance-oriented entities across the ecosystem are architecting a new, inclusive financial status quo. And when it comes to the immense potential of open financial systems, DeFi is just the foundation upon which the future of global finance will be built for the people, by the people.

To our fellow builders and future optimists: join us as we unlock open finance and knock down barriers to entry.

Testimonials & Use Cases

But don’t take our word for it. We asked some DeFi projects from the Aptos ecosystem why they chose to build on Aptos. Here’s what they said.

Sushi, a leading multi-chain decentralized exchange (DEX): “We chose Aptos for several key reasons: its fast time to finality, which is crucial for high-frequency use cases; its high throughput, which enables fast transaction processing; its on-chain order matching, enhancing security and transparency; and low gas costs, making it cost-effective for users and developers.”

Econia, a high-performance on-chain order book: “Aptos’ optimistic concurrency model allows for parallel execution of trades, empowering the blockchain to execute tens of thousands of non-trivial Move transactions per second. By leveraging the preset order of transactions and combining Software Transactional Memory (STM), Aptos easily handles large volumes of transactions at a fraction of a second through its Block-STM execution model.”

Merkle, a leveraged platform for decentralized trading: “Time to finality was the deciding factor for the team. On top of that, we enjoy using Move compared to other languages.”

Aries, a decentralized marketplace for lending, borrowing, and trading: “Aptos is the ideal foundation for us because it offers a high-performance blockchain network that allows us to seamlessly integrate and innovate. Its low transaction costs make it efficient for decentralized exchange activities, including borrowing, lending, leveraged trading, and AMM swaps.”

SwapGPT, an AI-powered DeFi aggregator and liquidity manager: “SwapGPT is bullish on the Aptos network's AI and DeFi potential. With a vision of simplifying user journey and enabling mass adoption, SwapGPT is building an interactive interface that lets users type or speak to meet their DeFi needs, accompanied by an AI pathfinder for transaction routing.”

Kana, a user-friendly and mobile-first DeFi app: “As early Aptos adopters, we were captivated by the Move language. Coming from an Ethereum Virtual Machine (EVM) and Solidity background, we recognized Move's potential as the ‘Solidity for non-EVMs.’ This language was the primary attraction for us as core developers. Our extensive work with Aptos has revealed its strengths, including impressive throughput and rapid finality. [...] We view Aptos as a partner rather than just another development chain.”