Ecosystem Spotlight: mirage protocol — Perpetual Futures, Powered by Aptos

Designed for speed, composability and capital efficiency, mirage aims to deliver a fully on-chain trading experience that doesn’t sacrifice performance.

Not an Illusion: A Clear Vision for Aptos DeFi

Now live on Aptos mainnet, mirage is a DEX offering perpetual futures contracts and other advanced trading primitives. As one of the first native perps DEXs in the Move ecosystem, mirage is building a comprehensive suite of modular liquidity products with a long-term vision: bring scalable, high-performance derivatives to DeFi.

At the heart of mirage’s trading infrastructure is mUSD, a protocol-native stablecoin used as margin across its trading platform. Unlike traditional stablecoins, mUSD is designed to be capital-efficient and composable, with its supply and utility directly tied to the activity and fees generated by the Mirage ecosystem.

A Next-Gen Trading Experience

mirage is built to offer a seamless experience for both traders and institutional strategies. By leveraging Aptos' parallel execution and low-latency infrastructure, mirage delivers a trading environment that mirrors the responsiveness of centralized exchanges while remaining fully on‑chain.

With the power of Aptos’ high-performance architecture and Move-based security model, mirage provides native support for:

Low fees and fast trade execution

Cross-margin and isolated margin accounts

A decentralized funding rate mechanism

Composability with other DeFi protocols

Together, mirage enables a permissionless and transparent trading layer for leveraged strategies on Aptos that promises high-speed execution with Block-STM, a composable infrastructure and scalable liquidity.

Expanding the DeFi Stack

Beyond perpetuals, mirage is actively developing additional products, including:

Leveraged tokens that package directional exposure in a liquid form

Options protocols for advanced hedging and speculative strategies

Liquidity layers to support scalable margin and collateral infrastructure across DeFi

Each new product in the mirage suite is designed to integrate with mirage's existing architecture, further expanding the utility of mUSD and deepening Aptos' derivatives ecosystem.

More Than a Mirage

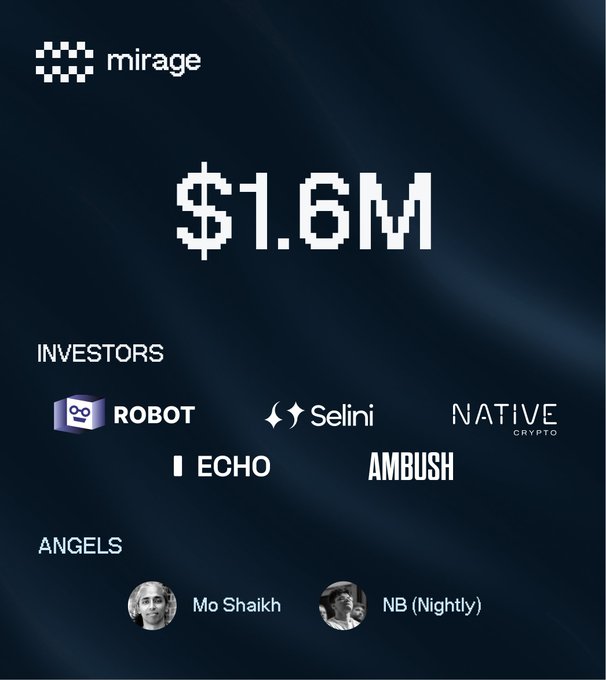

While mirage just launched its mainnet, it's already established a name for itself within the Aptos DeFi ecosystem—having recently closed a strategic funding round to grow its presence across the MoveVM landscape. With mUSD set to play a central role in the protocol’s growth, mirage is building a liquidity engine set to play a key role in Aptos DeFi.

From sophisticated trading tools to novel stablecoin mechanics, mirage is ushering in a new chapter for derivatives on Aptos that’s built for speed, designed for composability and powered by a decentralized future.

To learn more about mirage, follow them on X @mirage_protocol.

Disclaimer: This communication is for informational purposes only and should not be construed as financial, investment, legal, or tax advice. This material does not constitute an offer, solicitation, or recommendation to buy, sell, or hold any digital asset or engage with any DeFi protocol.