How Aptos Rapidly Became a DeFi Powerhouse

The Tone for 2025: Making Money Moves

Aptos is rapidly establishing itself as a stablecoin hub, with the arrival of native USDC and USDe. With all three of the world’s top stablecoins now live on the network, Aptos has opened the floodgates for more liquidity and more advanced DeFi. Case in point: the total stablecoins market cap on Aptos crossed $1B for the first time—a near 1,000% increase year‑over‑year.

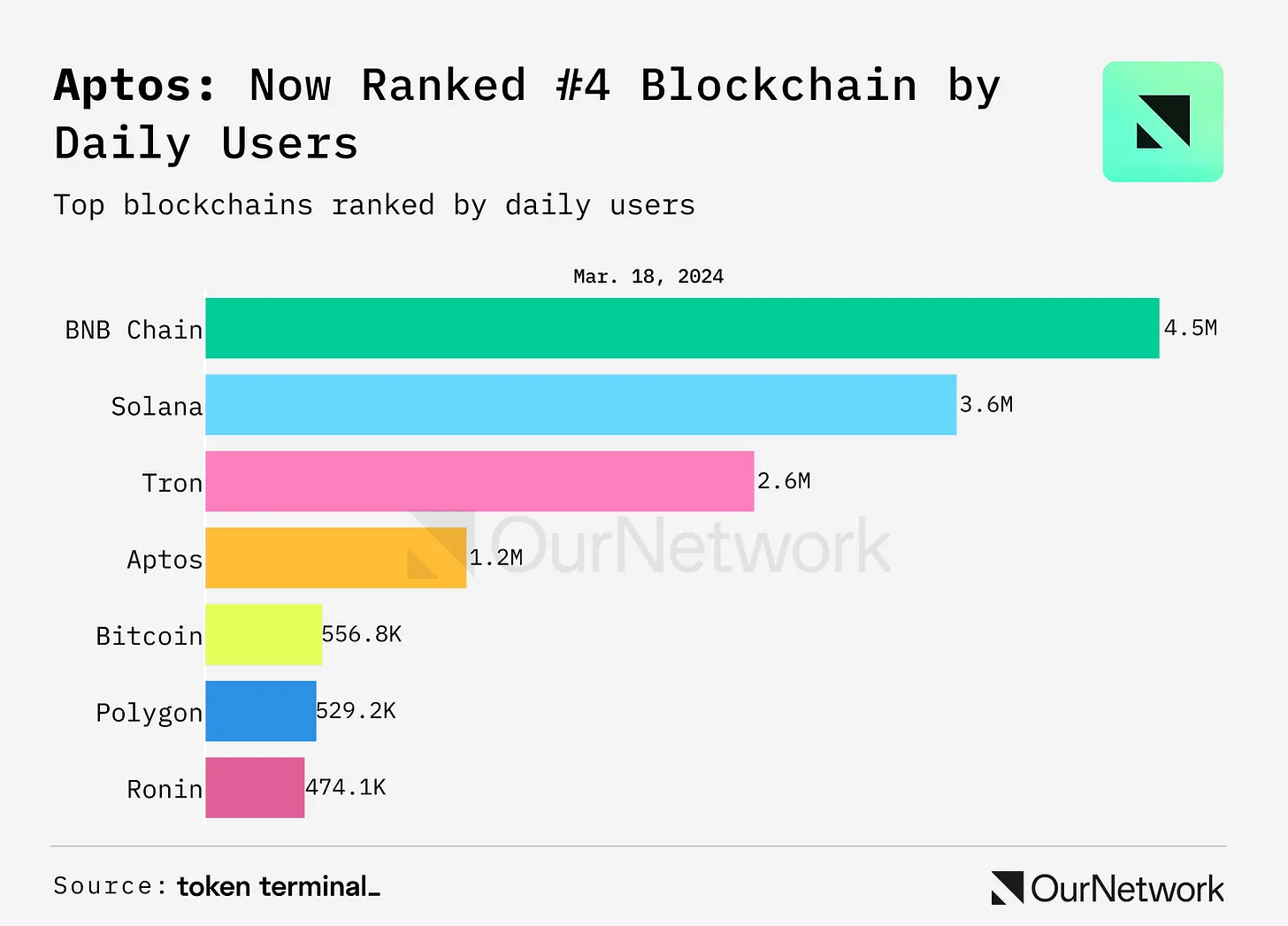

15 Million Reasons Why

Network activity is booming. Monthly active users are approaching 15 million, and Aptos now ranks #4 across all chains in daily active users—a clear sign that real users and real use cases are flocking to the network.

Aptos Foundation Commits $200M to Expand DeFi

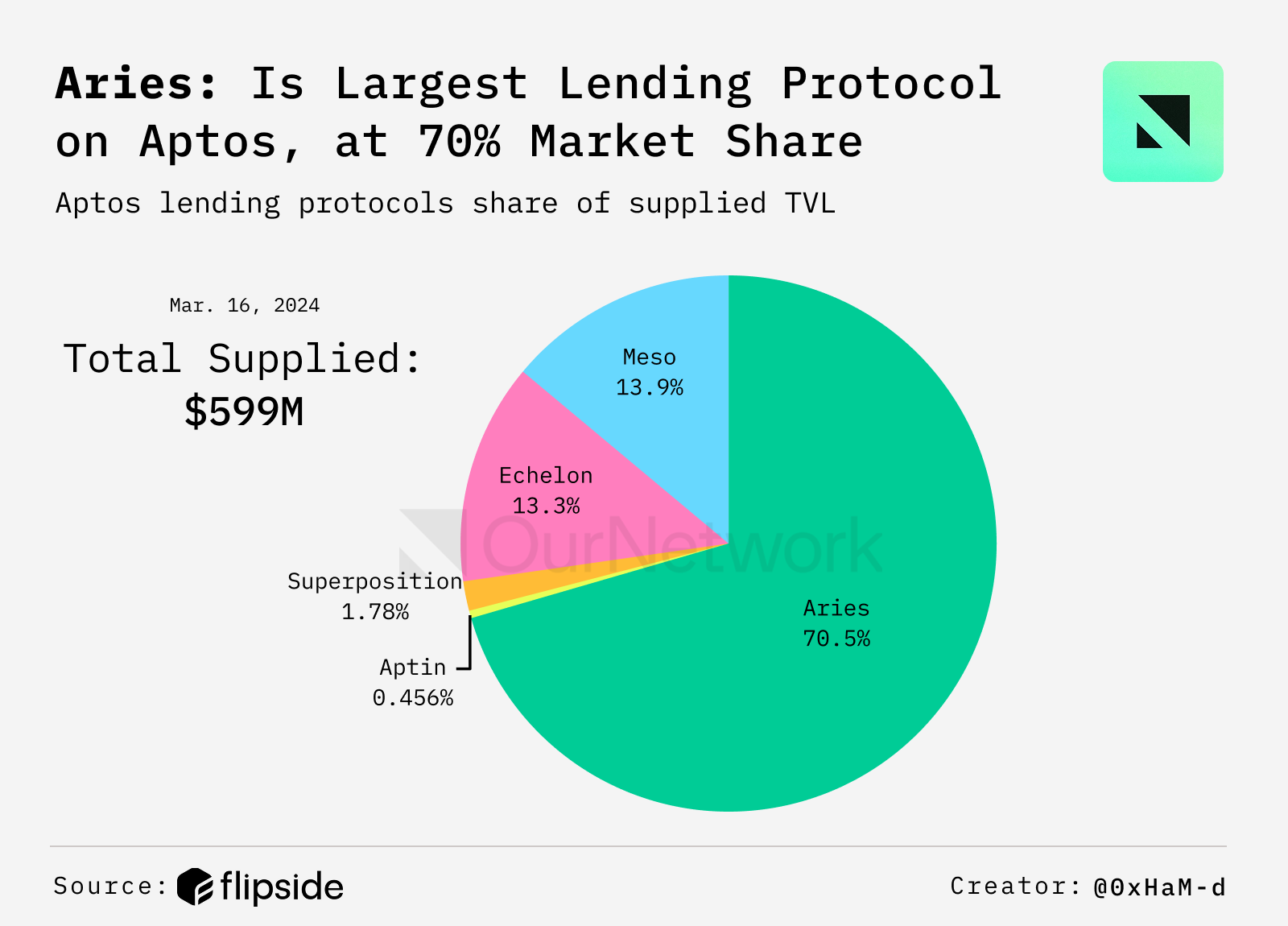

Aptos DeFi is thriving, with TVL holding above $1B driven by lending protocols like Aries Markets, Echelon, Meso Finance, and Superposition, which together account for ~$550M in TVL. To keep the momentum going, the Aptos Foundation has committed over $200M in grants and investments to fuel DeFi growth across AMMs, CLMMs, spot markets, and more—making Aptos one of the most well-capitalized ecosystems for buildersx

No Slowing Down for the DeFi OG

As the first and largest lending protocol on Aptos, Aries Markets continues leading the Move ecosystem with $600M in total deposits. Aries holds 70% of stable assets, with $220M in USDC and $200M in USDT. And with over 700,000 unique wallets as of Q1 ’25, it remains the most battle-tested DeFi primitive in the Move ecosystem.

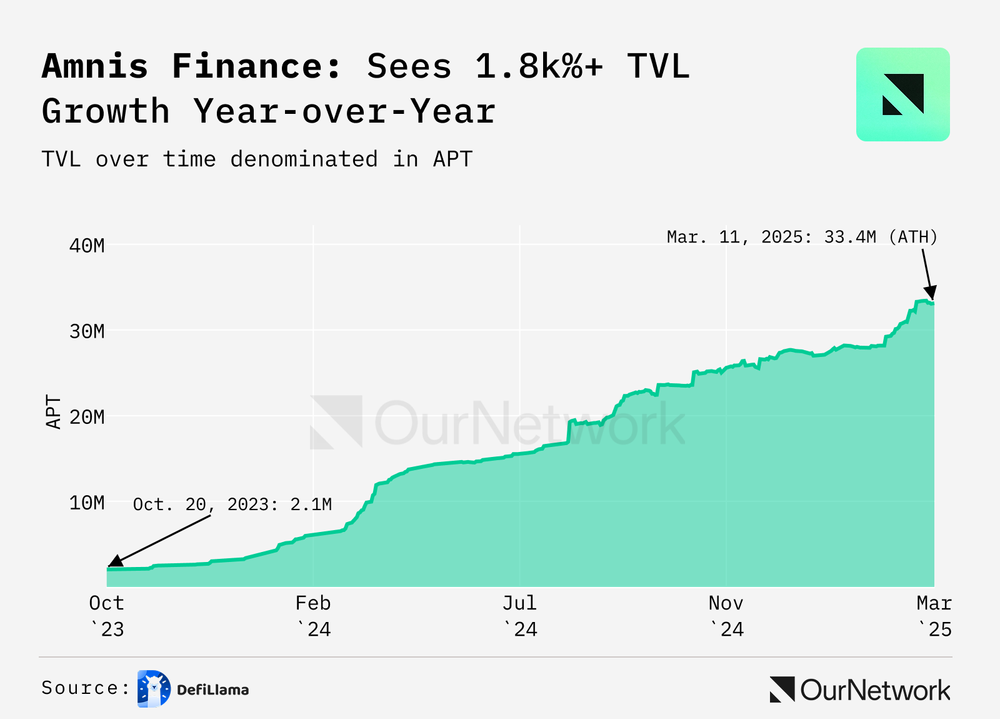

Amnis, LFM

Since launching in late 2023, Amnis Finance has seen explosive growth—up 1,882% year-over-year. In Q1 2025, monthly active wallets grew 181%, making it the fastest-growing protocol on Aptos. Amnis is also one of the earliest participants in the Aptos Foundation’s new LFM program, and just announced its Token Generation Event (TGE) last week.

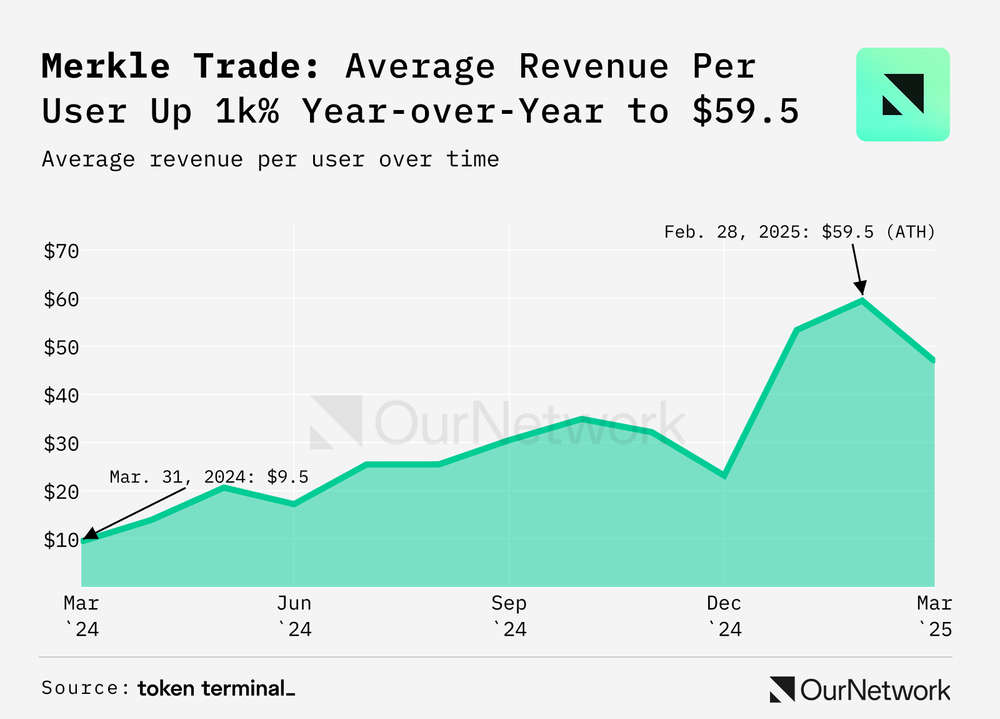

Merkle Shows the 10X Impact of UX

Merkle Trade, a leading user-friendly leverage trading platform, shows what happens when product experience meets user demand. In just 15 months, it’s facilitated $20B+ in volume across 160K+ traders. With gamified rewards and a focus on UX, Merkle saw a 1,000%+ increase in average revenue per user year-over-year. They’re still just warming up.

Thala and Echelon Anchor the DeFi Core

Rounding out the DeFi momentum are cornerstone protocols: Thala and Echelon. In February, Thala was responsible for over 50% of all Aptos DEX volume, with $130M+ in TVL and more than $4.5B in cumulative trading volume. Echelon, meanwhile, leads Move-native lending with $160M+ in TVL and serves as the primary lending venue for Ethena’s sUSDe on Aptos—holding $50.75M in supplied sUSDe, which represents over 93% of the stablecoin’s circulating supply. Together with fresh liquidity strategies and new capital inflows, these protocols are helping cement Aptos as a top-tier chain for active DeFi builders and users alike.

The Quiet DeFi Powerhouse

Aptos didn’t make noise—it made progress. While others chased headlines, Aptos quietly laid the groundwork for one of the most compelling DeFi ecosystems in the space. More than a billion in TVL, millions of users, and a new wave of high-performing protocols are proving that this network isn’t just fast—it’s foundational. In a world where money moves fast, Aptos is where it moves with purpose. See more insights from the OurNetwork Aptos Mega Issue Q1 2025.