Ecosystem Spotlight: Kofi Finance – Innovating Liquid Staking on Aptos

By combining performance and composability with ecosystem collaborations, Kofi isn’t just building a staking product—it’s helping shape the future of liquid staking on Aptos.

Fresh Roast of Liquid Staking Innovation

Kofi Finance kicked off its Aptos journey in February 2025 at Aptos Xpontential—a bootcamp designed to support promising early-stage teams building on Aptos. Held in New York City, the event helped jumpstart Kofi’s go-to-market motion and set the stage for collaboration across the ecosystem.

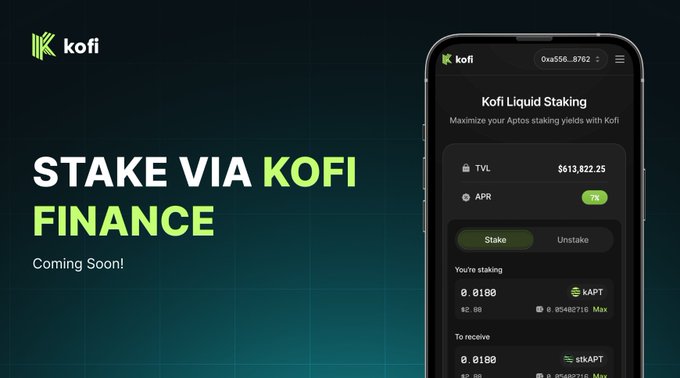

Since then, Kofi has positioned itself as a next-generation liquid staking platform. With a dual-token model—kAPT and stkAPT—Kofi enables users to stake their APT while maintaining flexibility across the Aptos DeFi ecosystem.

But Kofi was designed to offer more than traditional staking rewards. By integrating MEV sharing and native DeFi integrations, Kofi enhances the reward potential of staking while unlocking composability. Users who stake through Kofi receive liquid tokens representing their staked tokens, which can be used across lending markets, AMMs and other on-chain applications across the Aptos ecosystem. From DeFi protocols to liquidity infrastructure, Kofi’s has forged early partnerships with Aptos ecosystem projects including Echo Protocol, Moar Market, Joule Finance, Kana Labs, Superposition, Panora and Hyperion.

These integrations play a key role in extending the utility of Kofi’s liquid staking tokens while reinforcing Aptos as a vibrant home for DeFi innovation.

Perking Up Aptos DeFi

In March 2025, Kofi launched its testnet where members of the Aptos community were invited to stake, explore and experiment with its core liquid staking mechanics. The testnet saw strong early traction over just a few weeks:

2.1K unique testers

59K APT staked

$5K+ in bug bounties distributed

Following a successful testnet phase, Kofi officially launched on Aptos mainnet on May 14—surpassing $12M in TVL within just one hour of launch. With liquid staking now live, Aptos users can stake APT to earn staking rewards while also participating across the broader DeFi ecosystem.

What’s Brewing?

Kofi is building more than a staking product—it’s building infrastructure for decentralization and fair markets on Aptos.

Up next on Kofi’s roadmap is fostering validator inclusivity. Kofi’s delegation strategy is designed to support as many validators as possible, with a particular focus on smaller, community-run operators. By widening its delegation set, Kofi aims to promote decentralization and resilience across the network.

Kofi is also investing in Maximal Extractable Value (MEV)-powered yield strategies to unlock boosted staking rewards for stakers. Through MEV sharing, Kofi aims to:

Promote fair markets by reducing slippage in trading

Support higher yields for stakers

Create more efficient, user-first staking dynamics on Aptos

As liquid staking on Aptos continues to evolve, Kofi is helping define what comes next—pairing performance with decentralization, and usability with yield.

To keep up with the latest from Kofi, follow them on X @Kofi_Finance.