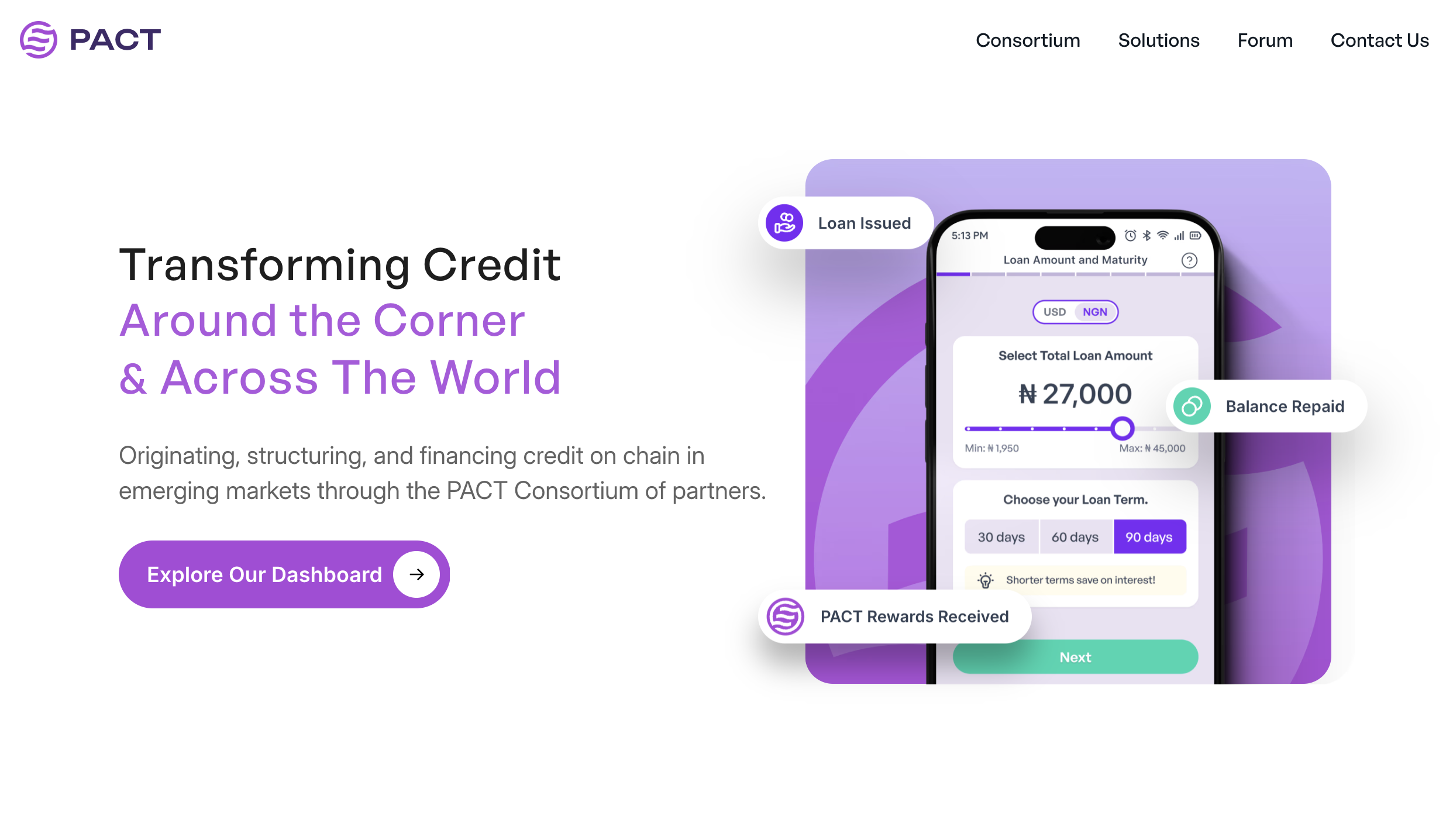

PACT

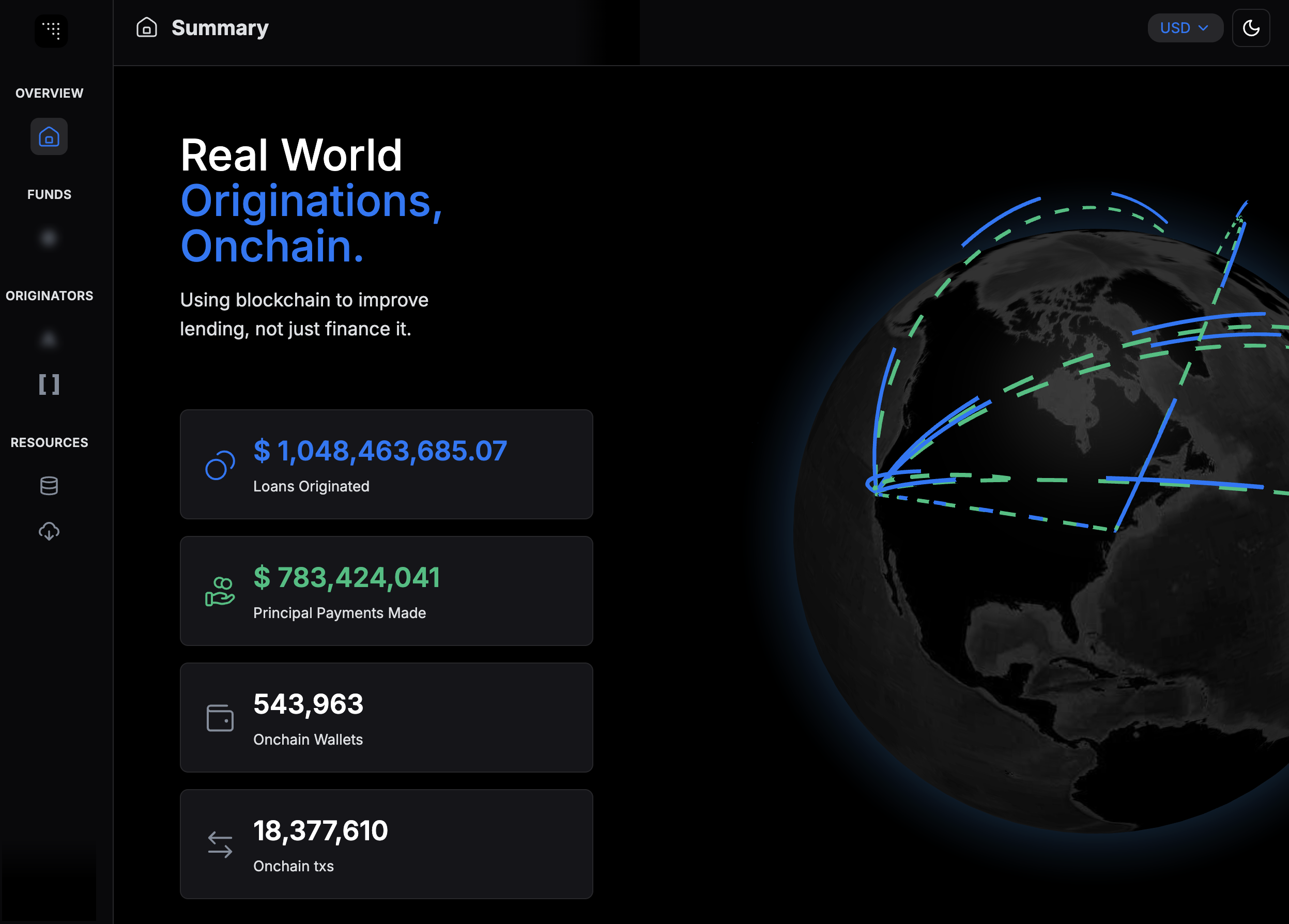

Launched on Aptos after nine months of incubation with the Aptos Foundation, PACT brings over $1 billion in on-chain assets and delivers fully on-chain lending and securitization infrastructure for licensed lenders in emerging markets. PlatformsLaunched on Aptos after nine months of incubation with the Aptos Foundation, PACT brings over $1 billion in on-chain assets and delivers fully on-chain lending and securitization infrastructure for licensed lenders in emerging markets.

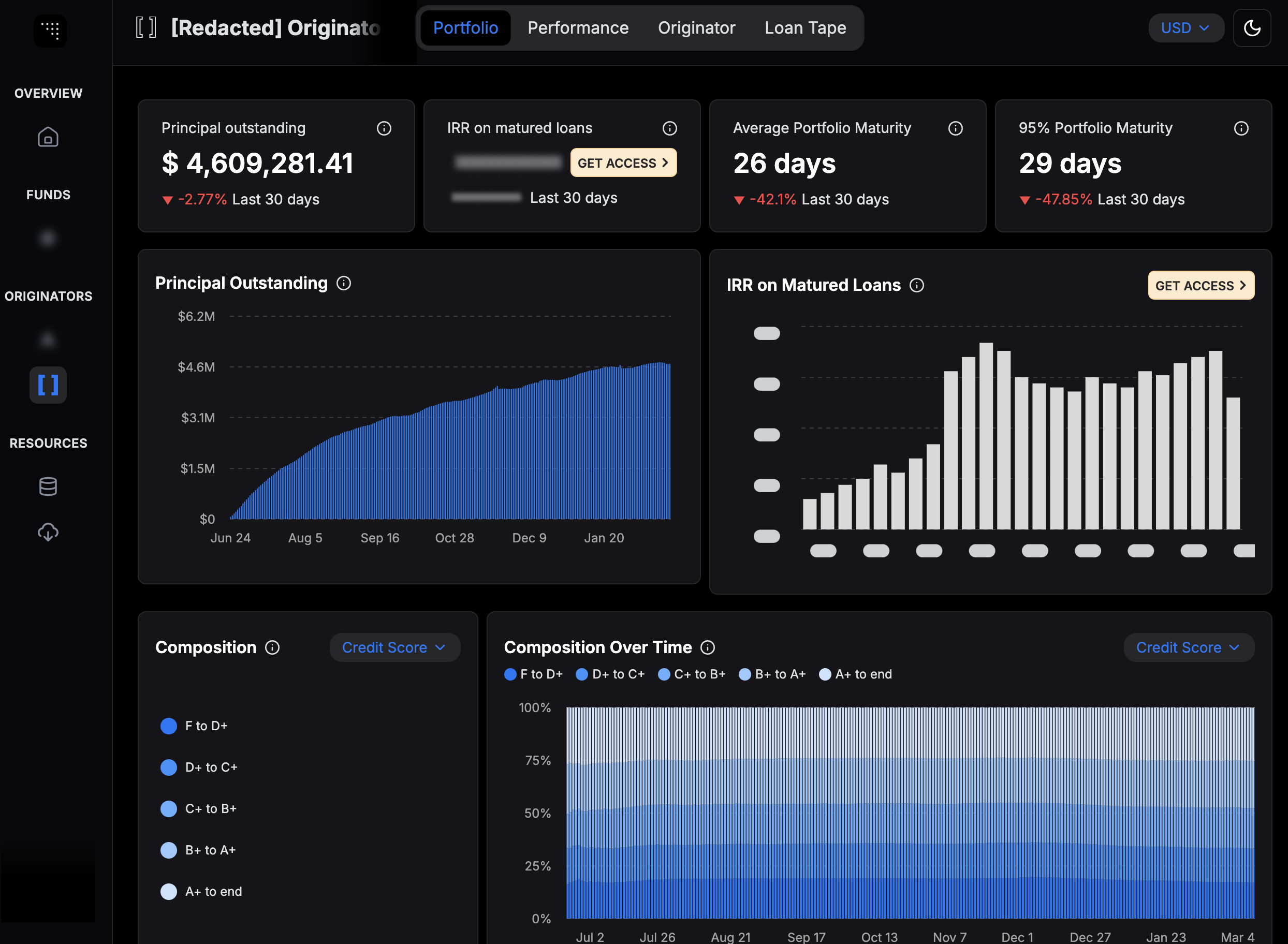

PACT is revolutionizing private credit by leveraging blockchain technology to create a more efficient, transparent, and accessible financial ecosystem. By eliminating intermediaries and reducing costs, PACT enables seamless lending, securitization, and investment in real-world assets, making structured credit more liquid and scalable. The private credit market, valued at $1.7 trillion and growing rapidly, is still in the early stages of on-chain adoption, with just $17 billion currently tokenized. PACT has already facilitated over $1 billion in loans, ranking as the fourth-largest protocol in the space, with an ambitious goal to reach $10 billion by the end of the year. At its core, PACT transforms debt markets by providing an on-chain infrastructure for loan origination, securitization, and automated servicing. Borrowers gain direct access to global capital at lower costs, while investors benefit from real-time transparency and automated risk management. By leveraging smart contracts and decentralized governance, PACT removes inefficiencies in traditional lending, enabling a more open and equitable financial system. The $PACT token plays a central role in the ecosystem, functioning as both a governance and incentive mechanism. Token holders participate in protocol decisions, stake tokens for rewards, and benefit from a fee-driven value accrual model. Protocol revenues generated through loan origination, securitization, and investment servicing are partially used for buybacks and burns, creating long-term sustainability and value appreciation.

PACT stands apart by integrating directly with institutional lenders, stablecoin issuers, and asset managers, ensuring deep liquidity and real-world adoption. The protocol’s ability to remove costly intermediaries reduces expenses by over 50%, making private credit more accessible to a global audience. On-chain transparency ensures full auditability of transactions, increasing investor confidence and improving regulatory compliance. Unlike traditional debt markets, where opacity and inefficiencies slow capital flows, PACT provides a fully automated, trustless lending environment.

Built on Aptos, PACT benefits from scalable, low-cost, and secure infrastructure. Aptos’ Move-based smart contract technology ensures efficient execution, allowing PACT to scale seamlessly and support millions of borrowers and investors worldwide. The protocol’s ability to handle high transaction volumes while maintaining security and efficiency makes it the ideal platform for large-scale institutional adoption.

PACT is not just a lending platform; it is the foundation for a new financial infrastructure that brings private credit fully on-chain. With rapid adoption and billions in projected growth, the protocol is poised to redefine how debt markets function in the digital age. As blockchain finance continues to evolve, PACT is leading the way in transforming private credit into a more transparent, accessible, and scalable industry.

Showcase Your Project

If you have a project built on Aptos, we invite you to share it with us.