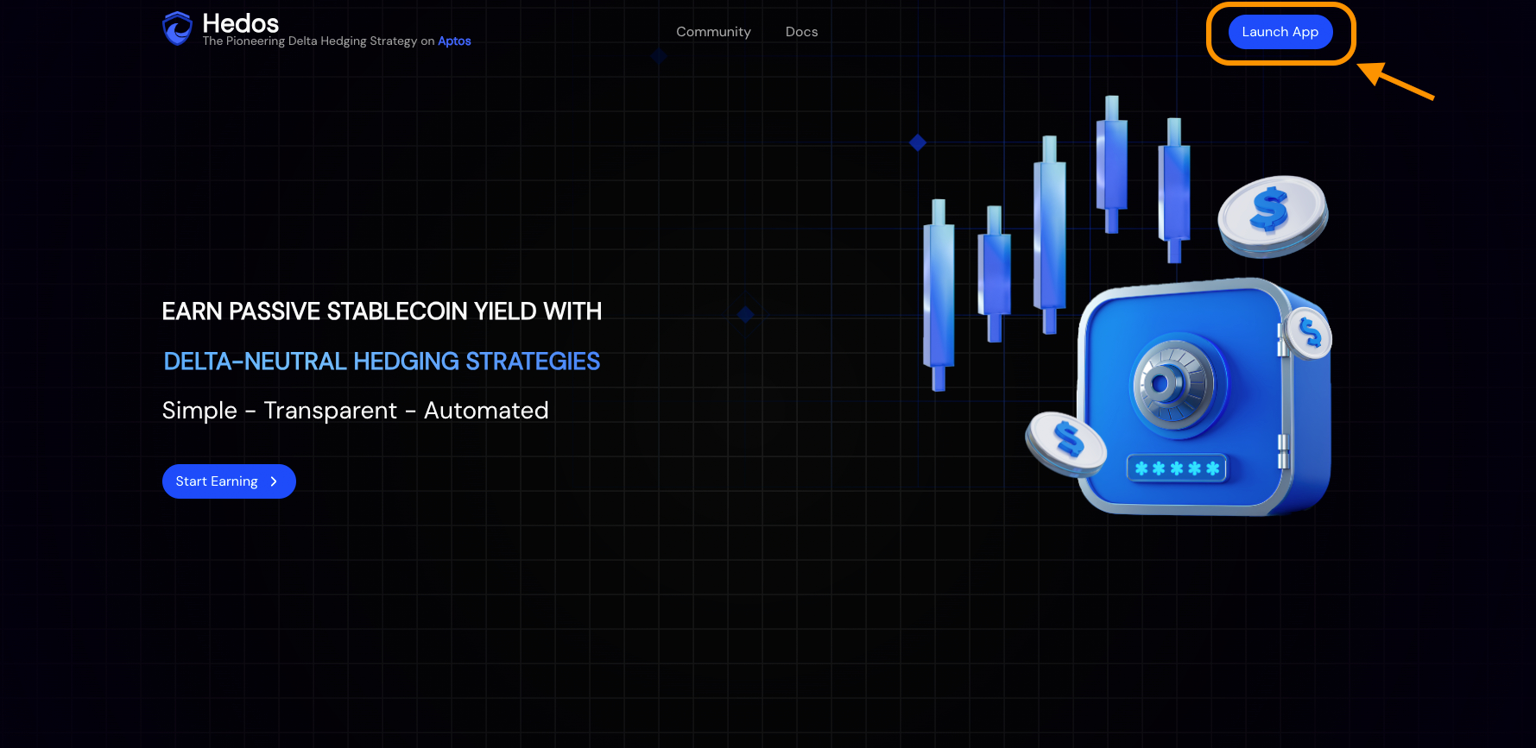

Hedos Finance

Unlock idle stablecoins with hedged, risk-managed DeFi strategiesPlatformsHedos Finance is a next-generation DeFi protocol on Aptos designed to unlock idle stablecoins through delta-neutral yield strategies. In traditional DeFi, users are often exposed to unpredictable volatility, making it difficult to generate safe and sustainable returns. Hedos solves this by offering hedged, risk-managed vaults that generate consistent yields while protecting user capital. At its core, Hedos provides users with two vault modes - Safety Mode and Turbo Mode — allowing them to choose returns based on their risk appetite. Safety Mode prioritizes capital protection by absorbing less profit but shielding users during drawdowns, while Turbo Mode offers higher upside potential in favorable markets in exchange for increased risk. The protocol’s controller engine continuously monitors funding rates, leverage levels, and market exposures across integrated DeFi and perpetual trading venues. When deviations occur, Hedos automatically rebalances positions — adjusting borrow sizes, reallocating liquidity, or closing positions — to maintain neutrality and prevent liquidation. This auto-rebalancing ensures that users can earn stable yields without actively managing strategies themselves. Hedos sources its yield from: Funding rates in perpetual markets (currently the main driver). Yield farming incentives from Aptos-native DeFi protocols. Lending and borrowing activities to smooth returns. Future integrations of arbitrage opportunities and external incentives for diversification. Security and risk management are central to Hedos. The protocol enforces strict leverage caps, continuously monitors real-time positions, and implements circuit breakers that pause actions during extreme volatility. External audits are scheduled prior to mainnet launch, alongside a bug bounty program to encourage white-hat participation. Additionally, Hedos emphasizes on-chain transparency, making strategies and performance metrics visible to all users. The project is backed by A-Star Group, a leading Web3 venture studio in Vietnam, and powered by Centic.io, a next-gen Web3 intelligence infrastructure. The Hedos team consists of over ten professionals with academic and industry experience, including alumni of top Vietnamese universities and international programs (e.g., Tsinghua University). In a short time, Hedos has earned recognition as the 2nd Winner at the Vietnam Aptos Hackathon and was named among the Top 10 projects in the Vietnam Web3 Leaders Fellowship. Looking forward, Hedos Finance envisions becoming the yield layer of Aptos, powering lending, staking, and trading with risk-managed capital. Tokenomics — currently under development — will combine governance, rewards, and utility designed for long-term alignment rather than short-term speculation. By combining advanced hedging mechanics, transparent risk management, and user-friendly vaults, Hedos Finance aims to deliver the safest path to stablecoin yield in the Aptos ecosystem, shaping the foundation for risk-aware DeFi adoption.

Showcase Your Project

If you have a project built on Aptos, we invite you to share it with us.